| A. |

General Overview

2025-2034 RUPTL is a 10-year business plan of PLN, as approved by the Minister of Energy and Mineral Resources (MEMR), to cater Indonesia’s projected electricity demand. It includes power plants procurement plan, Commercial Operation Dates of each power plant, and PLN’s strategies to maintain a balanced and reliable national power supply. |

| B. |

Power Generation under the 2025-2034 RUPTL |

| B.1. |

Increased Target of Power Generation Capacity and Renewable Energy Share

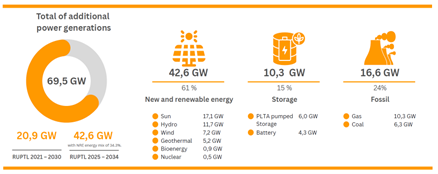

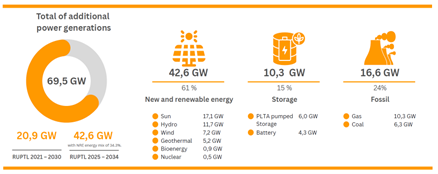

- PLN sets an ambitious target of adding 69.5 GW new capacity (from 40.6 GW capacity in the previous RUPTL), with the following allocation across the energy mix:

- The allocated share for renewable energy power plant marks a sharp increase from 51.6% in the previous RUPTL (2021-2030) to become 61% This aligns with the Government’s commitment and effort to accelerate the energy transition, reducing carbon emissions, and achieving its renewable energy targets.

- Another notable interesting highlight is that the Government continues to include development plans for new coal-fired power generation, provided they fulfill the criteria and conditions elaborated in D.1. below. The MEMR, in its press-conference held on 26 May 2025, explained that the rationale of this policy is to ensure a stable and affordable electricity supply for the public and support the industrialization initiatives of the Government.

|

| B.2. |

Utilization of Nuclear Power and Hydrogen.

- To further diversify the national energy mix, the 2025-2034 RUPTL now sets a specific plan for the development of nuclear power plants in the Sumatera and Kalimantan islands, with a total projected capacity of up to 0.5 GW. On 4 June 2025, the MEMR announced that the Government will issue an implementing presidential regulation on nuclear power generation in 2025.

- The 2025-2034 RUPTL highlights PLN’s commitment to utilizing hydrogen as one of the Government’s key pillars, through utilization of (i) hydrogen for co-firing steam and gas turbine (combustion-based) and (ii) fuel cell hydrogen for power generation, both at utility scale and for residential use as well as fuel. The 2025-2034 RUPTL shows PLN’s plan to develop Hybrid Solar PV and Battery Power Plant as well as fuel cell hydrogen in Sumba, Nusa Tenggara Timur (NTT) as its pilot project.

|

| B.3. |

Power Plant Development Strategy

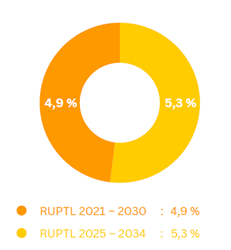

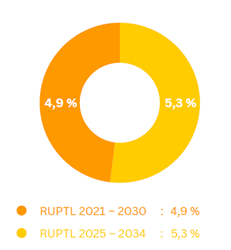

- In the 2025–2034 RUPTL, PLN projects an average electricity demand growth of 5.3% per year.

- To cater the projected demand, PLN allocates the development portions into two following clusters:

- PLN’s or PLN’s subsidiaries’ portion: PLN allocates 20.4 GW, constituting 29% of the total target of additional capacity, to be developed by PLN, either by itself or through its appointed subsidiaries. This portion can be carried out in cooperation with other parties, provided that PLN or its subsidiaries must hold at least 51% shareholding proportion, directly or indirectly, in the project company.

- Private IPP portion: The remaining 49.1 GW, constituting 71% of the total target of additional capacity, is allocated for private IPPs. PLN’s subsidiaries may co-participate in this portion, with shareholding proportion to be contractually agreed between the parties.

|

| C. |

Power Transmission and Distribution |

| C.1. |

Increased Target of Power Transmission and Distribution Network and Substation

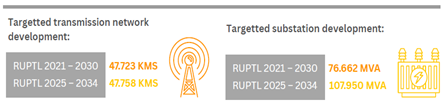

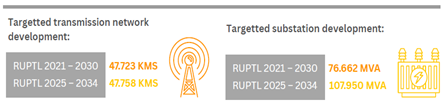

- To support the increased target of power generation, PLN also increases its targets for power transmission and distribution infrastructure compared to the previous RUPTL (2021-2030):

- transmission network: from 47,723 to 47,758; and

- Substation: from 76,662 MVA to 107,950 MVA.

- Transmission network development projects are to be carried out by PLN through the appointment of EPC contractors, or, with respect to transmission network linked to private IPP-owned power plants, by the respective IPP companies based on the technical and designed guidelines specified by PLN.

- The 2025-2034 RUPTL also allows transmission network development to be implemented through partnerships with private entities or with government support. Potential funding schemes include State Capital Injection (PMN), Public-Private Partnership (PPP), Islamic financing, deferred payment schemes, and using financing institutions like PT Sarana Multi Infrastruktur (SMI) under the Energy Transition Mechanism (ETM) country platform.

|

| D. |

Roadmap to Net Zero Emission |

| D.1 |

New Coal-Fired Power Generation (PLTU)

In line with Presidential Regulation Number 112 of 2022, the 2025-2034 RUPTL prohibits the development of new PLTU projects, except for:

- Existing PLTU projects included in the RUPTL approved by MEMR prior to the issuance of Presidential Regulation Number 112 of 2022; or

- New PLTU projects that meet the following conditions:

- Integrated with industries that are developed with a focus on increasing the added value of natural resources or included in National Strategic Projects (PSN), and making a significant contribution to job creation and/or national economic growth;

- The project company commits to reduce greenhouse gas emissions by at least 35% within 10 years since the operation of power generation; and

- The operation of the power plant shall cease to operate by 2050.

|

| D.2 |

Carbon Capture Storage (CCS)

PLN plans to carry out CCS initiatives, by capturing and purifying CO₂ emissions from fossil fuel-based power generation through several separation steps involving the use of amine compounds, starting from 2030. |

| D.3 |

PLN Renewable Energy Certificate (REC)

- PLN’s REC is one of PLN’s green product innovations available for power generation projects developed by PLN or private IPPs selling the generated electricity to PLN.

- The 2025–2034 RUPTL explicitly regulates that RECs or other green attributes generated from renewable energy power plants within the PLN system are owned by PLN, and therefore, can only be sold by PLN. It will be interesting to see how this evolves, as the latest MEMR regulation on power purchase agreement on renewable energy allows PLN and IPPs to negotiate the ownership of green attributes (such as carbon credit and renewable energy certificate) generated from renewable energy power generation.

|

| D.4. |

Carbon Trading by PLN

Up to 2024, PLN has several carbon credit projects, both traded in voluntary and mandatory carbon markets. For instance, the hydro power generation projects located in Musi, and Sipansihaporas are traded in voluntary market, whereas geothermal power generation projects located in Lahendong and Kamojang and combined cycle gas turbine projects in Muara Karang are traded in mandatory markets. The 2025-2034 RUPTL affirms PLN’s commitments to continue such practice for other power generations projects, where the proceeds from carbon trading can be used to support the development of renewable energy power plants that help reduce carbon emissions. |